Update

Thematic joins Stocktwits

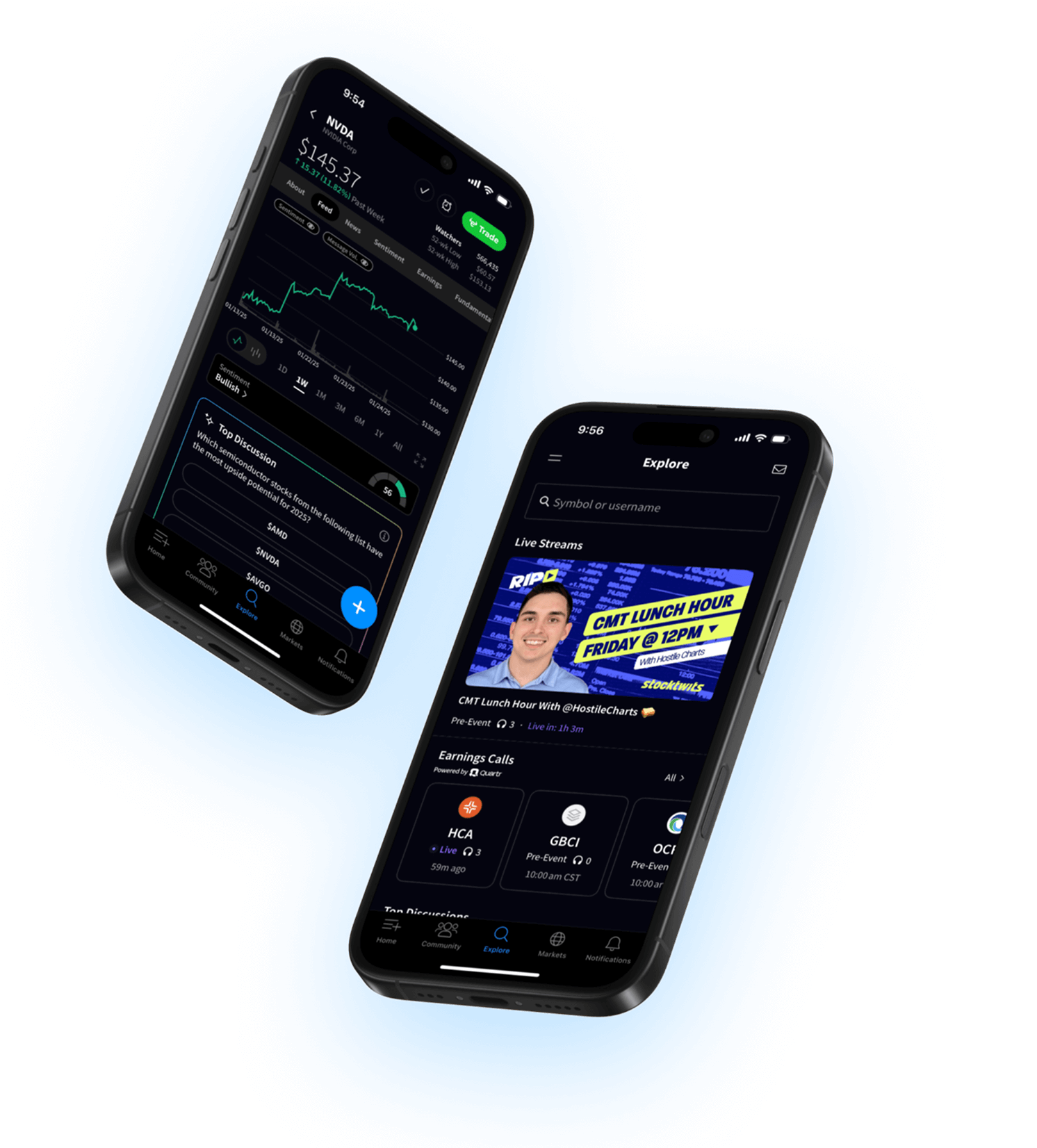

Stocktwits is the leading social investing platform, with over 10 million users across 200+ countries. Powered by 17 years of proprietary data and real-time sentiment—and now accelerated by its acquisition of Thematic—Stocktwits is delivering alpha-driving insights and a new generation of AI-powered research, discovery, and decision-making tools.